At the time, he got a nice thick set of documents, a fancy binder, and peace of mind. He put the binder on his shelf, never looked at it again, and never heard from his lawyer again. He died thinking it was all handled.

You can imagine our surprise then when, after his death, we were stuck dealing with the probate court and his ex-wife. The exact things my father-in-law had spent good money to protect us from having to deal with.

It turns out that his fancy set of documents had never been updated, so they were out of date. And his assets weren’t even titled in the name of his estate plan.

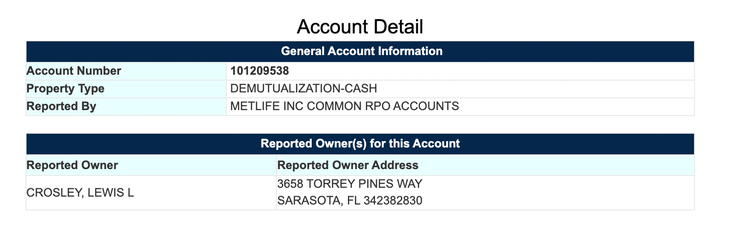

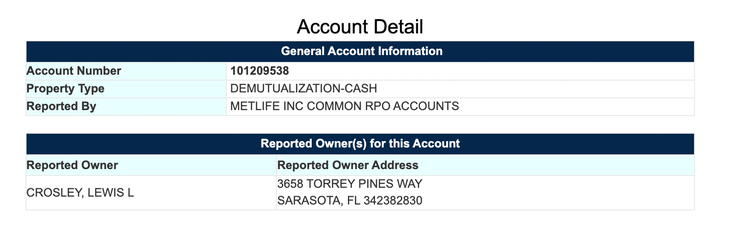

On top of that, they hadn’t even been inventoried, so to this day, we’re still finding assets like this one in the Florida Department of Unclaimed Property.

I thought for sure, this must have been malpractice.

But my work at one of the most famous law firms in the country confirmed: This was common practice.

Lawyers everywhere were putting in place form documents they know won’t work when their clients' families need them, not because they are bad people or bad lawyers, but because that’s how they were trained.

Form documents, no updating of the documents or regular communication with the clients once the plan was done, no inventory of the assets to ensure that all assets could be found after the death or incapacity of a loved one, not ensuring that assets were titled properly to make sure the plan even worked.

On top of that, I later discovered that the plans lawyers were putting in place for families with minor kids at home had huge roles that left the kids at risk of being taken out of the home and into protective custody while the will and named guardians were located.

When I left to start my own law firm, I made a commitment to create something truly meaningful for my clients, plans that would actually work when their families needed it and provide not only true peace of mind, but a process that would support my clients to not just plan for death, but to become better parents, better business owners, and better community citizens during life, as well.

Now, Personal Family Lawyer members across the globe are being trained in the right way to plan for families and be there for your loved ones when you can’t be.